snohomish property tax payment

Please refer to the back of your tax statement to determine eligibility or you may contact the Snohomish County Assessors Office at 425-388-3540 for additional information. Median Property Taxes No Mortgage 3534.

About Efile Snohomish County Wa Official Website

I have read the above and would like to pay online.

. The Treasurers office will give a grace period for seniors and qualifying disability renewal applications for property tax exemptions. Snohomish Boys. Snohomish WA 98291-1589 Utility Payments PO.

You must have an existing account before you can sign in with Google. What is the property tax rate in Snohomish County. We are now accepting credit card payments in-house along with online.

To get help with online payments either email the treasurer with your question or call customer service at 425-388-3366. PO Box 1589 Snohomish WA 98291 360-568-3115 Terms and conditions Contact us. Taxes Tax Statistics For rate questions visit Washington State Department of Revenue or call 800-547-7706.

Prefer not to login. Pay for services online. If paying after the listed due date additional amounts will be owed and billed.

Due to the financial hardships caused by the COVID-19 pandemic Snohomish County Treasurer Brian Sullivan and Executive Dave Somers have extended the first-half 2020 property tax deadline to June. Regional Transit Authority RTA No. Your bill comes with a self-addressed return envelope for your convenience.

1-Utility Bill Payment 2-Payments for PBIA Fee Park Rentals Special Event Fees NO UTILITY PAYMENTS. Use the search tool above to locate your property summary or pay your taxes online. Welcome to the City of Snohomish online credit card debit card and e-check payments portal.

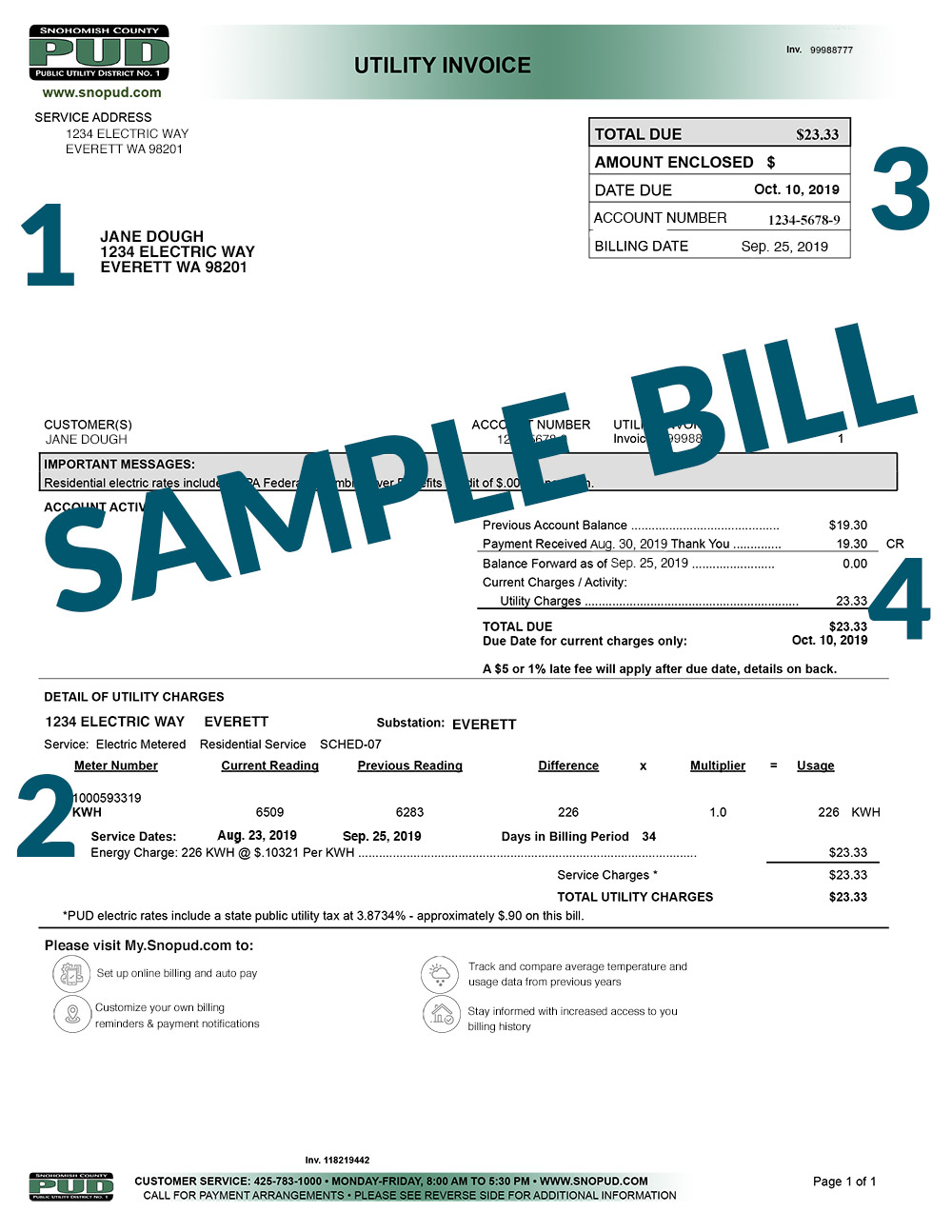

The Assessor and the Treasurer use the same software to record the value and the taxes due. The following links maybe helpful. Please include your PUD bill payment slip to avoid any delays in processing your payment.

You will need a current statement from Snohomish County to create an account. Once you have registered for a Paystation account you can instantly access and manage your bills from Snohomish County. Stay logged in.

Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related Phone. Online City Utilty Payments. 425-262-2469 Personal Property.

Securely make a payment with a credit card debit card or by eCheck. Help with Online Payments. Other Places to Pay with Credit Cards.

PO Box 1100 Everett WA 98206-1100. Snohomish WA 98291-1589 Utility Payments PO. Median Property Taxes Mortgage 3638.

Online City Utilty Payments. Snohomish County Property Tax Payments Annual Snohomish County Washington. The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of 338600.

Make check or money order payable to. Please select below the type of payment you are making. There are three primary phases in taxing property ie devising levy rates assigning property market worth and receiving receipts.

Check money order cashier check. Receipts are then dispensed to associated taxing units via formula. Use the search to locate and pay your bill with Quickpay instead.

Snohomish County Treasurer 425-388-3366. Use My Location Everett. Snohomish County Assessor 3000 Rockefeller Avenue Everett WA 98201 Phone.

Snohomish Boys. Taxes Tax Rates and Information For rate questions visit Washington State Department of Revenue or call 800-547-7706. Search for Property Taxes.

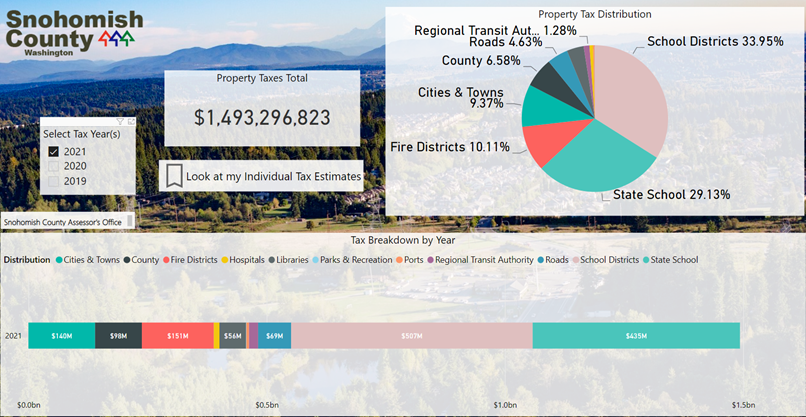

Snohomish Countys average tax rate is 089 of assessed home values which is well below the national average of 11 and slightly below the Washington statewide average of 092. Please note that 1st Half Taxes are Due April 30th and 2nd Half Taxes are Due October 31st. Taxing authorities include Snohomish county governments and numerous special districts like public schools.

Do Not Show Again Close. Make a one time payment below using your Parcel ID OR use the Create an account link to make future payments easier. Public Transportation Benefit Area PTBA Snohomish PTBA.

Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related Phone. Treasurer Tax Collector Offices near Everett. Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related Phone.

Taxes Tax Statistics For rate questions visit Washington State Department of Revenue or call 800-547-7706. Using this service you can view and pay them online. Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related Phone.

Based on that 089 rate Snohomish County homeowners can expect to pay an average of 3009 a year in property. Snohomish County has one of the highest median property taxes in the United States and is ranked 155th of the 3143 counties in order of. The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information.

Snohomish County collects on average 089 of a propertys assessed fair market value as property tax.

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

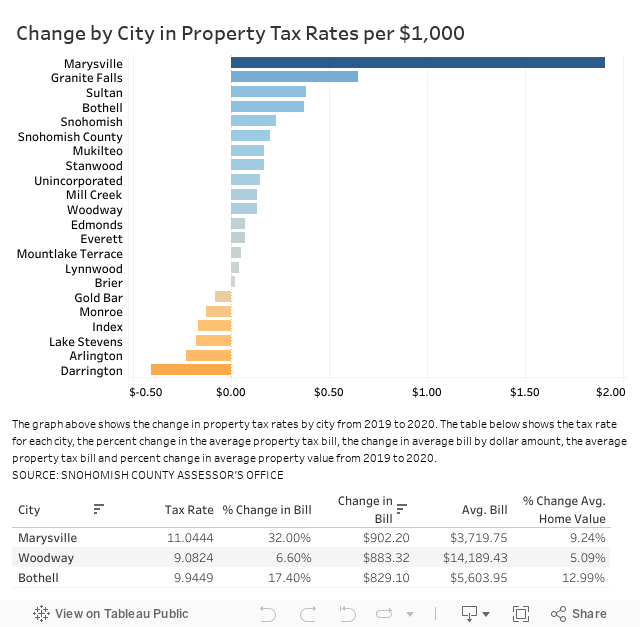

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

This Is Interesting Airbnb Sent Out This Email To Past Patrons Now You Can Donate Money To Landlords What Do Y Kindness Gifts Being A Landlord Clay Food

Partnership Agreement Templates 16 Free Word Pdf Samples Words Business Template Templates

Graduated Real Estate Tax Reet For Snohomish County

Snohomish County Property Tax Exemptions Everett Helplink

Property Taxes And Assessments Snohomish County Wa Official Website

Property Mls 1693341 10413 240th Place Sw Edmonds Wa 98020 In Snohomish County Wa Has 4 Bedrooms 1 Backyard Views Low Maintenance Yard Real Estate Trends

Monroe Historical Society September 21 Page 1 Historical Society Cherry Valley Newspaper Archives

Mountlake Terrace City Council Approves Property Tax Increase Code Updates Mltnews Com

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

Tax Payment Options Snohomish County Wa Official Website

How To Read Your Property Tax Statement Snohomish County Wa Official Website

My Billing Statement Snohomish County Pud

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Tax Payment Options Snohomish County Wa Official Website

News Flash Snohomish County Wa Civicengage

County Aims For Denser More Affordable Missing Middle Homes Heraldnet Com